- Details

- Breaking News

Mosselbayontheline has been threatened and bombarded with emails and telephone calls to immediately remove an article published on our Facebook page and website regarding Afro Fishing’s controversial and heavily contested application to add a R350 million pelagic fish meal and oil processing facility to its sardine cannery on Quay 2 on the Mossel Bay harbour.

The deadline for commentary on the application according to the public participation process by the environmental consultants Cape EAPrac is 12 December 2019. The public’s grave concerns regarding the overwhelming environmental impact of such a risky industry in the smallest working harbour in the country regarding foul odours, noise, air and water pollution as well as the marine life, infrastructure and tourism-based character of the town, was addressed at a public meeting in the Mossel Bay town hall on 20 November 2019.

In the Facebook article published on 25 November 2019 we referred to the ongoing international #fishrot scandal that rocked the Namibian fishing industry and led to the immediate resignation and incarceration of several ministers and senior officials.

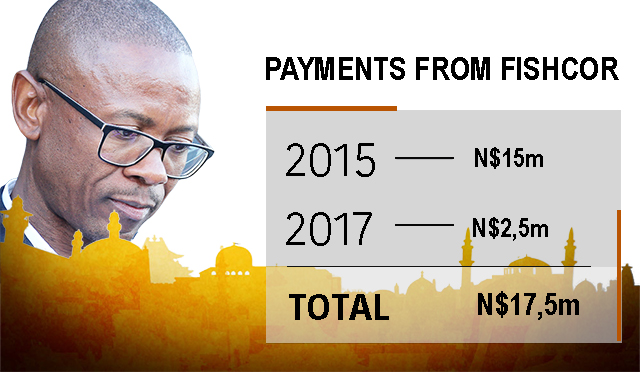

We mentioned that one of Afro Fishing’s two directors, Mr Johannes Breed, is also the managing director of the Angola-based company African Selection Trust (AST) which co-owns Seaflower Pelagic Processing (60% share) with the Namibian state-owned fishing company Fishcor (40%). The latter is prominently under investigation in the #fishrot scandal.

In various articles in Namibian and other international newspapers, it has been mentioned repeatedly since 2017 that AST is represented on Seaflower Pelagic’s board by Breed as well as economist Adriaan Louw and lawyer Maren de Klerk.

As part of our contribution towards the public participation process and in the light of the shocking revelations of corruption, bribery, nepotism and state capture in the fishing industry being exposed in the ongoing investigation, we also sent an email to Me. Melissa Mackay of CapeEaprac, requesting that the public participation process regarding Afro Fishing’s application be halted until the #fishrot investigation has been completed.

Other concerned I&AP’s were cc’ed in the email as the public participation process is of public concern and supposed to be transparent. The underneath email caused a flutter of phone calls and legal threats from Afro Fishing’s managing director Deon van Zyl and attorney Donald Curtis from A Chimes Van Wyk Attorneys in George.

The offending part in the article reads:

Die bom en #fishrot-Wikileaks-skandaal van omkopery, geldwassery en korrupsie ter waarde van dermiljarde dollar in die internasionale visbedryf om toegang tot Namibië en Afrika se visbronne te kry, het ook ‘n plaaslike visreukie deur die betrokkenheid van een van Afro Fishing se twee direkteure by die Namibiese staatsmaatskappy Fishcor waarop die soeklig nou ook skerp val.

Johannes Breed (37), ‘n geoktrooieerde rekenmeester, is ook die besturende direkteur van die Angola-gebaseerde maatskappy African Selection Trust (AST) wat op sy beurt ‘n 60%-aandeel in ‘n nuwe Namibiese maatskappy Seaflower Pelagic Processing (Pty). Ltd het, terwyl Fishcor die ander 40% besit. Volgens die Namibiese koerant, The Namibian, verteenwoordig Breed, sowel as die ekonoom Adriaan Louw en prokureur Maren de Klerk AST op Seaflower Pelagic se direksie.

Volgehoue bewerings dat Fishcor (en AST by implikasie) onreëlmatige geld en ‘n viskwota van N$1,8 miljard oor ‘n 15-jaar periode van die Namibiese minister van visserye en mariene hulpbronne, Bernard Esau, ontvang het, word onder meer nou ondersoek.

Esau, asook Namibië se minister van justisie, Sacky Shanghala, het hul bedanking ingedien en is in hegtenis geneem sedert dié omkoopskandaal oor viskwotas die afgelope tien dae wêreldwyd opslae gemaak het. Dit kom ook te midde van Mosselbaaiers se kommer oor Afrio Fishing se planne vir ‘n vismeelfabriek en owerheidsplanne vir akwaboerderybedrywighede met geelstert in Mosselbaai se waters.

Our email to senior consultant Ms Melissa Mackay on 27 November 2019

The handing of a fishing quota to the benefit of a foreign company contradicts a government commitment to “Namibianise” the fishing industry, critics in Namibia say.

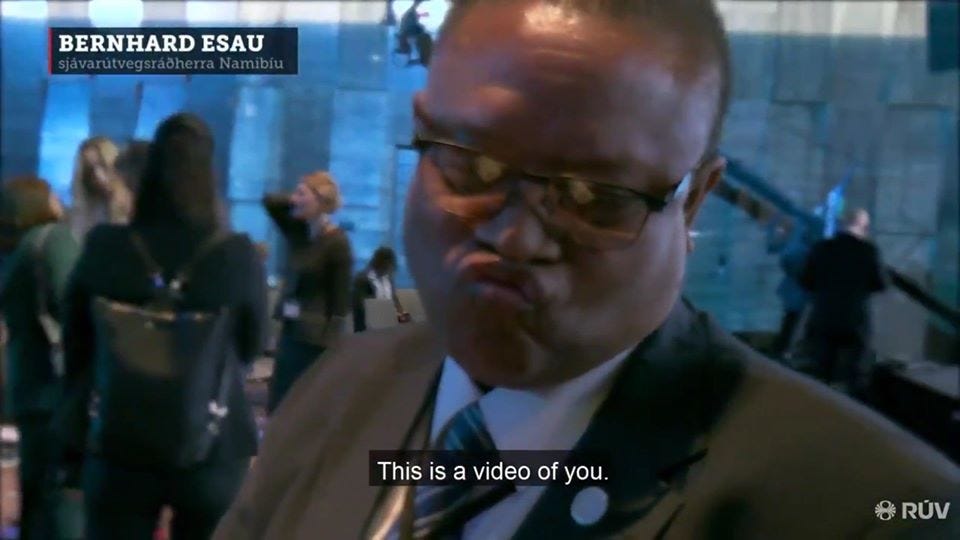

Namibia’s fisheries minister, Bernard Esau, has handed the state-owned National Fishing Corporation of Namibia (Fishcor) a fishing quota potentially worth N$1.8-billion in a controversial deal that will benefit an international company, official documents show.

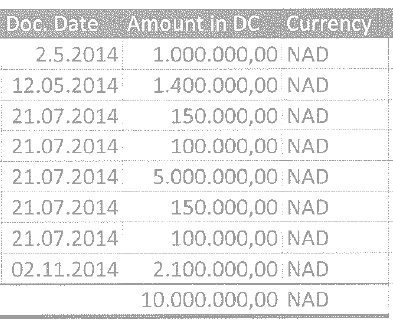

In the latest development, The Namibian newspaper has seen an agreement struck between Esau and Fishcor in 2017 in terms of which the minister promised to make available to the parastatal at least 50,000 metric tonnes of horse mackerel each year for 15 years.

Fish traders estimate that the quota is worth about N$120-million (R120-million) annually, or about N$1.8-billion in total.

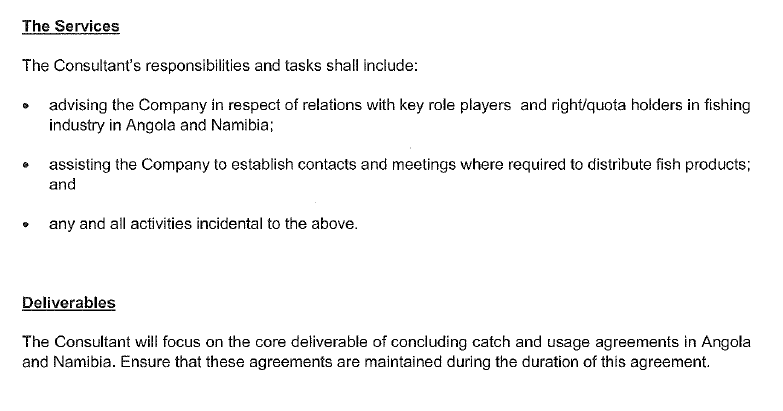

The agreement, announced in a May 2017 government gazette, led to the formation of Seaflower Pelagic Processing, a joint venture between Fishcor and African Selection Fishing Namibia, which is owned by the Angolan-based African Selection Trust (AST).

African Selection, which operates a fish processing plant in Namibe, southern Angola, holds 60% of the shares, while Fishcor holds the balance.

Fishcor is represented on Seaflower’s board by its chairperson, James Hatuikulipi, and its chief executive, Mike Nghipunya, while AST is represented by South African accountant Johannes Augustinus Breed, Namibian economist Adriaan Jacobus Louw and Namibian lawyer Maren Brynard de Klerk.

The joint venture will be responsible for setting up a factory to process 600 tonnes of horse mackerel a day. The plant will be located on land bought by Fishcor for N$160-million from Etale Properties, a company partly owned by Namibian businessman Jose Luis Bastos.

The deal has sparked a storm of criticism in Namibia.

2018-04-13

The Namibian reported this week that fisheries minister Bernhard Esau handed Fishcor a fishing quota worth more than N$1,8 billion over a 15-year period. This deal would also benefit an Angolan-based company which partnered Fishcor.

It has turned out that Fishcor did not only get a sweetheart deal from the fisheries ministry, but the parastatal paid N$50 million more on the fish factory that is old.

The details and background of this transaction are included in documents obtained by The Namibian, while seven people who were either involved or directly briefed on this matter, confirmed the details of this deal.

Most of the people did not want to be named because they fear that the fisheries ministry would cut their fishing quotas in retaliation for their comments.

Etale Fishing, which closed in 2013, laying off about 700 workers, owned the property through its subsidiary, Etale Properties.

The sources said Etale Fishing put the factory up for sale in 2015 for N$110 million, which was the valuation of that property. A source said the factory was valued by another valuer at N$90 million in 2015.

Etale Fishing eventually sold the factory in 2015 to well-connected Walvis Bay businessman Jose Luis Bastos, who was a director of Etale at the time.

The exact price paid by Bastos for the factory is unclear, but two people said it was between N$70 million and N$85 million. Bastos then sold the factory to Fishcor the following year for N$160 million.

Bastos declined to comment on the price he bought the property for from Etale.

“I cannot tell you. I don’t want to be rude to you, but my business is my business. I sold the property two years ago,” he said.

Fishcor never publicly advertised the tender for buying the fish factory, a decision that would have given the state-owned fishing company better options.

Esau’s supporters claim that the minister’s decision to spoon-feed Fishcor with 50 000 metric tonnes of fish every year (around N$120 million) is aimed at empowering Namibians.

Some critics have, however, argued that the Fishcor transaction is favouring a state-owned entity that has a history of failing and forcing the closure of private fishing companies which employ thousands of Namibians.

In fact, the new fish factory ownership will be foreign-dominated since it is managed by a new company called Seaflower Pelagic Processing, a joint venture between Fishcor (40%) and the Angolan-based African Selection Fishing Namibia (60%).

One of Etale Fishing’s former directors told The Namibian this week that the sale of the factory was “very questionable”, and that the state-owned company must explain and account for the transaction.

“They must explain how they ended up being the buyers of that property,” the former owner-director said, adding that fisheries minister Esau should also explain the purchase of the property.

Esau did not want to comment on Fishcor when approached by The Namibian on Wednesday, saying he can only comment after his ministerial budget discussion was completed in parliament.

As it stands, Fishcor’s new partner in Seaflower Pelagic Processing, which is majority-owned by a South African businessman based in Angola, will take up the market left by Etale Fishing and Bidvest Fishing that is expected to close any time soon after reduced quotas.

The former director said the fall of Etale Fishing is a setback to empowerment in Namibia.

“This was the only black-owned processing plant in the country at the time. I cannot even tell you how everything happened. You know when you are standing in the middle of a storm, a real storm, a hailstorm, you don’t know what is going on around you, and the next thing you know is everything is over. This is what happened with Etale,” the ex-director said.

Fishcor demolished the Etale factory, but the former owner said the factory had not reached the end of its useful economic life, as claimed by Fishcor.

Fischor plans to build a N$530 million fish factory, but people familiar with the factory said even this amount appears inflated.

The Namibian understands that several Cabinet ministers are nervous about the Fishcor saga.

A person familiar with this matter said Fishcor board chairperson James Hatuikulipi and the parastatal’s management briefed the board last year, and some board members visited the plant at Walvis Bay.

DENIAL

Fishcor’s chief executive, Mike Nghipunya, told The Namibian last week that the purchase of Etale Properties was a strategic move “as it is the only available piece of land with quay (besides the sea) access”.

Good morning Ms Wessels

Thank you for your email. As has been previously stated and included in the Basic Assessment Report, Afro Fishing does not have any fishing quotas but obtains fish from companies that have legal quotas allocated to them.

This Environmental process relates to the construction and operation (in terms of air quality) of a fishmeal and fish oil production facility on Quay 2 of the Port of Mossel Bay. It is being undertaken in terms of the 2014 Environmental Impact Assessment Regulations and the process is bound by the statutory timeframes and requirements as gazetted in the regulations.

This process will thus continue as explained in the presentations of the 20th November 2019 and in the Draft Basic Assessment Report. Your comments will be included in the report to be submitted to the competent authority.

Regards

Melissa Mackay ǀ 084 584 7419

SENIOR CONSULTANT ǀ ECO ǀ GIS

LEGAL THREATS RECEIVED ON SAME DAY per email & FB messenger:

Email received from attorney Donald Curtis on November 28 2019:

Madam,

Attached is an urgent letter for your attention, which requires a response.

Please confirm you have received same by reply to this email.

Yours faithfully,

http://mosselbayontheline.co.za/index.php/chimes-attorneys-letter

Download Link:

Mosselbayontheline's reply by email on 29 November 2019:

Message received on Sunday 1 December from Mr Donald Curtis per Facebook Messenger:

Dear Ms Wessels, Your email on 29 November to my work email address, This email address is being protected from spambots. You need JavaScript enabled to view it. refers.

Please be advised our instructions are to proceed with the urgent High Court Application. With sincere respect, the substantial damage to our client’s good name and reputation is ongoing for so long as all of the articles and/or posts regarding our client remain “live” on your website and/or your Facebook page.

There are quite literally hundreds of attorneys in the Southern Cape who could already have assisted you. Our client cannot accept the risk that you fail to respond by Friday 6 December 2019, or that your response is one of continued denial of the defamation of our client and only bring a court application thereafter.

In particular, in those circumstances, our client has created its own urgency. Thus, we repeat our request to you to forthwith remove all articles and/or posts regarding our client remain “live” on your website and/or your Facebook page, and per your reply to this email, confirm you have done so. We are busy at this very moment drafting the application. It will be served on you per email and via Facebook if not this afternoon then early tomorrow morning. Our client’s rights are strictly reserved in full.

Yours faithfully,

Donald Curtis

Read more here how the #fishrot scandal and investigation is progressing and watch the video below:

- Related Articles:

- SA at sea over illegal fishing in its waters

- Fish meal and fish oil factory proposed on Quay 1 at Mossel Bay harbour

- Petition against fish meal plant in Mossel Bay's harbour

- Misdaad, bendegeweld en politieke magspel laat gevaarligte flikker in mooie Mosselbaai

- Moet al ons visbronne uitgeroei word vir 'n vismeelaanleg en wie baat regtig daarby?

- Fish Meal Plant - the A-Z of what Afro Fishing's plans are

- Vrae en vrese oor vismeelaanleg in Mosselbaai vererger oor te veel vaaghede

- A fishy business . . . who are the international Big Fish behind Afro Fishing's R350 M fish meal plans?

- Vismeelfabriek en gehokte visplase - weet Mosselbaaiers wat hul geliefde '2017 Dorp van die Jaar' gaan tref?

- FISHGATE quota scandal between Angola and Namibia just the tip of the iceberg - many other companies investigated

- Icelandic and Russian captains arrested as fishrot scandal deepens